Blockchain: Financial Applications

As we continue moving forward with Artificial Intelligence, the Internet of Things and other up-and-coming technologies, we still see blockchain trying to advance in various fronts.

Some argue that blockchain will probably not succeed because of the privacy stakes and the difficulties it has faced demonstrating its usefulness. But others still vouch for what can come out of it and suggest that maybe the technology can flourish thanks to the applications that could stem from it.

On this post, let's explore some of those applications that could save blockchain from its demise.

Blockchain for finance

Some banks have kept distance from blockchain technology but others are investing and researching on it.

The financial giant, Mastercard, has been a pioneer in adopting blockchain and using it in their technology, currently holding up to 30 different patents with the technology. But what benefits can blockchain offer here? Within those patents, we can find "anonymous transactions", fighting credit card duplication scam, and innovative card verifications.

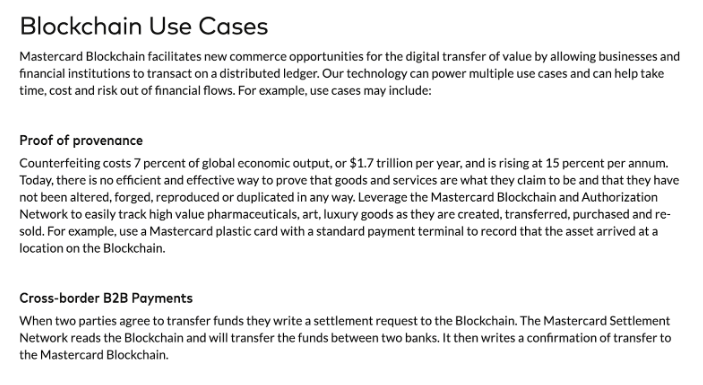

If we go to their developer website, they also include interesting use cases for commercial uses of blockchain technology such as proof of provenance and cross-border B2B payments.

Fraud control

In a previous post detailing some use cases for Blockchain in Telecom, we talked about how the technology allowed for identity verification and could help lower fraud levels. And when it comes to financial applications, it also rings true according to many.

Blockchain technology could make identity theft more difficult since there's a decentralization of keys and they all need to match accordingly.

Bojan Simic, CTO and Co-Founder at Decentralized Authentication provider HYPR Corp. explains on an article about blockchain preventing identity fraud:

"Essentially, decentralization in tandem with the use of public-key cryptography (PKI) makes cyberattacks like mass data breaches far less scalable. It could disrupt the fraud model sufficiently to where wholesale identity breaches subside. Because the database within the blockchain is encrypted, accessing the information would be unfeasible for anyone other than whoever has access to the crypto keys. Blockchain technology protects the line of trust by requiring proof of credentials at that moment, in addition to approval from the server and conformity of the network to acknowledge the request."

Modernizing the banking industry

How will the technology continue to disrupt financial services and even make the leap inside changing banking? This video by EY Global explores the possibilities of the future of banking with cryptocurrency and blockchain technology.

Do you trust blockchain technology? What other applications are you looking forward to see? Start a conversation about this or any other industry topic by going to our Expert to Expert section.